crypto tax calculator usa

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. You simply import all your transaction history and export your report.

Bitcoin Taxes Bitcointax Twitter

We offer a free trial so you can try out our software and get comfortable with how it works.

. In this example the cost basis of the 2 BTC disposed would be 35000 10000 500002. Dont have an account. Select the tax year you would like to calculate your estimated taxes.

Select your tax filing status. You simply import all your transaction history and export your report. CURRENT FILING STATUS Estimated Taxable Income Cost of.

If you are using ACB Adjusted cost base method the cost basis of sale will be determined by. Tax doesnt have to be taxing. Crypto Tax Calculator Use the calculator below to estimate the tax bill for your cryptocurrencyBitcoin sales.

As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while. Enter Your Personal Details. This means you can get your books.

20 28 for residential. Overall Accointing has features that put it among the best crypto tax calculators to consider. This means you may owe taxes if your coins have increased in value whether youre using them as an investment or like you would cash.

Enter your taxable income. The free trial allows you to import data review transactions. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

Read on to find out how to calculate cryptocurrency taxes in a fuss-free way with a crypto tax calculator. What is covered in the free trial. For the 202223 tax year you pay CGT at the following rates.

Check out our free Cryptocurrency Tax Interactive Calculator that in just one screen will answer your burning questions about your cryptocurrencyBitcoin sales and give. 10 18 for residential property for your entire capital gain if your overall annual income is below 50270. Straightforward UI which you get your crypto taxes done in seconds at no.

The information provided on this website is general in nature and is not tax accounting or legal advice. Its easy to set up and get started either on a desktop or mobile device. US Tax Guide 2022.

Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. This means you can get your books. Use our crypto tax calculator below to.

As with any investment it is. Over the last decade cryptoassets have burst on to the investment scene and captured the imagination of investors all over the world. Use code BFCM25 for 25 off on your purchase.

Capital Gains Tax Calculator Estimate What You Ll Owe

Cryptocurrency Taxes A Guide To Tax Rules For Bitcoin Ethereum And More Bankrate

7 Best Crypto Tax Calculators 2022 Accounting Software Guide

Crypto Taxes Usa 2022 Ultimate Guide Koinly

Crypto Tax And Portfolio Software Cointracker

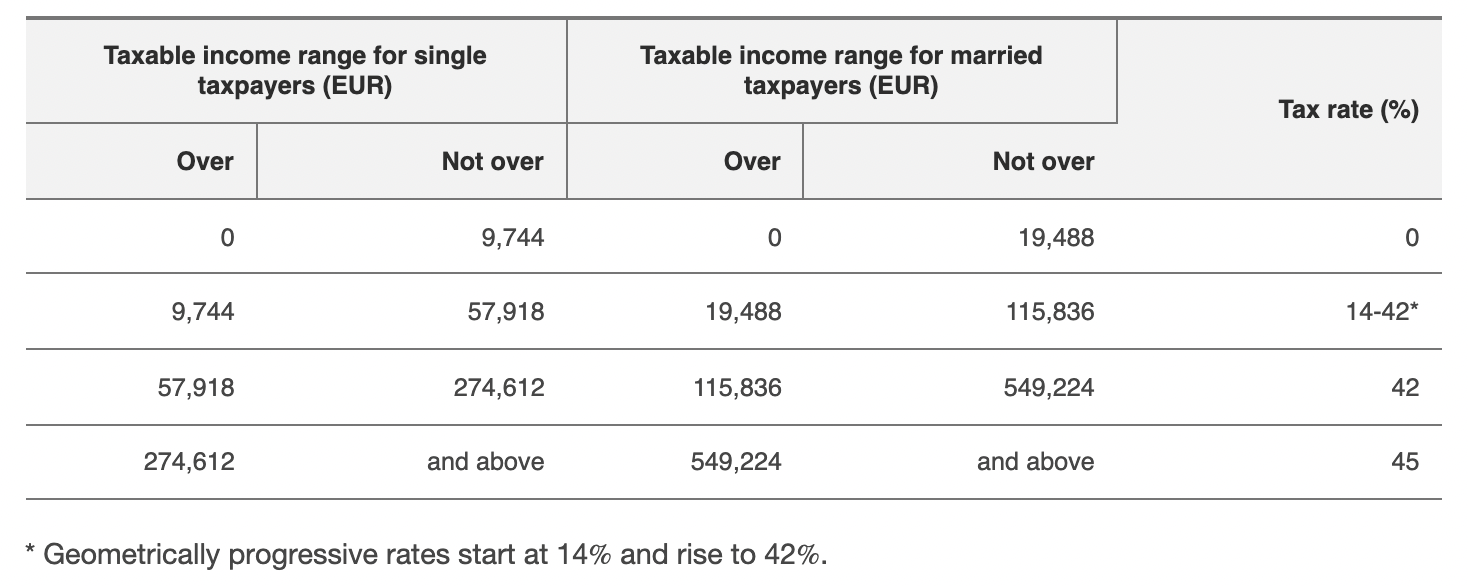

How Does Germany Taxes Crypto How Much Tax Do You Pay On Crypto In Germany Is It Really Tax Free

Best Crypto Tax Software Top 7 Tax Tools In 2022 Complete List

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

7 Best Crypto Tax Software To Calculate Taxes On Crypto Thinkmaverick

A Capital Gains And Tax Calculator For Your Stock Crypto Investments R Personalfinancecanada

Crypto Tax Calculator Australia 2022 Calculate Profit And Tax For Free Marketplace Fairness

Cryptocurrency Tax Calculator 2022 Fully Updated

Capital Gains Tax Calculator Ey Us

![]()

Cointracking Crypto Tax Calculator

Cryptotaxcalculator Reviews Read Customer Service Reviews Of Cryptotaxcalculator Io

7 Best Crypto Tax Software To Calculate Taxes On Crypto Thinkmaverick

Free Crypto Tax Calculators 2022 Calculate Your Bitcoin Taxes For Free

Cryptocurrency Tax Calculator Forbes Advisor

You Should Know That Crypto Com Have Their Own Free Crypto Tax Calculator R Cryptocurrency